3 taxes taken out of paycheck

These accounts take pre-tax money which means that your contributions come out of your pay before income taxes do. Another way to manipulate the size of your paycheck - and save on taxes in the process - is to increase your.

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

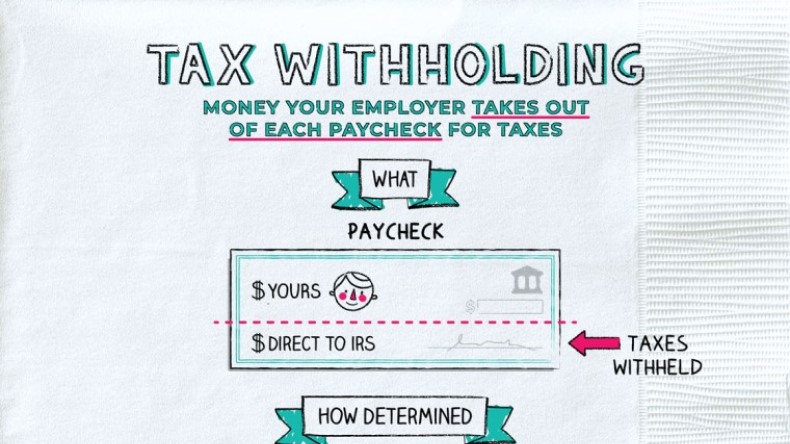

Check your paystub and use a W-4 Calculator to find out if you need to make any changes to your federal income tax withholding this year.

. Eligible plan types include traditional IRAs and 401ks. For example the top 20 receives 591 of all income and pays 643 of all the taxes so they arent carrying a huge extra burden. Connecticut has a set of progressive income tax rates meaning how much you pay in taxes depends on how much you earn.

Total income taxes paid. We are a leading online assignment help service provider. Resident for tax purposes until you notify the Secretary of Homeland Security and file Form 8854.

Remember that whenever you start a new job or want to make changes youll need to fill out a new W-4. All your academic needs will be taken care of as early as you need them. You can also choose to shelter more of your money from taxes in retirement accounts like a 401k or 403b.

Social Security-- --. Positions taken by you your choice. And as frustrating as it can you must get yourself familiar with these taxes to know where those chunks of your income go.

Follow the instructions for the form and. Total income taxes paid. 531 Method of Payment for Compensation Last Modified on January 25 2018 Section 7511 of the BOR Policy Manual states that electronic funds transfer is the required method of payroll payments to employeesAll employees are required to be paid by electronic funds transfer by authorizing the direct deposit of funds into their financial institution account within thirty 30.

You can request for any type of assignment help from our highly qualified professional writers. See Example 1 below 2. 2021 Filing Requirements for Dependents.

And For a sole proprietor or independent contractor. This paycheck calculator will help you determine how much your additional withholding should be. 215 Amount taken out of an average biweekly paycheck.

The distribution of an excess contribution taken out after the due date including extensions of your return is subject to tax even if used for qualified medical expenses. Understanding them can also open your mind that they are not just pure deductions but also benefits you from being a US. 672 More From GOBankingRates.

2813 Amount taken out of an average biweekly paycheck. Residents of Connecticut dont have to pay local taxes as there are no cities or towns in the state that charge their own income taxes. In Miami on Monday the average was 389 a gallon Fort Lauderdales average was 386.

California has the highest state income tax at 133 with Hawaii 11 New Jersey 1075 Oregon 99 and Minnesota 985 rounding out the top five. The redesigned Form W-4 makes it easier for you to have your withholding match your tax liability. For example you can have an extra 25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4.

In addition to withholding federal and state income tax you also need to withhold federal social security and Medicare taxes from your employees wages. We provide assignment help in over 80 subjects. See chapter 3 to find out if someone can claim you as a dependent.

If you terminated your residency after June 3 2004 and before June 17 2008 you will still be considered a US. States and cities that impose income taxes typically have their own brackets with rates that tend to be lower than the federal governments. Termination of residency after June 3 2004 and before June 17 2008.

And the answer to this new question can be found in Figure 7. Overview of Connecticut Taxes. How large can my loan be.

But if you prefer to have more tax than necessary withheld from each paycheck you will get that money back as a refund when you file your tax return keep in mind though you do not earn interest on the amount you overpay. The employers portion of both taxes is deductible on your Federal income tax return which can help to offset the sting of paying both parts of the Social Security and Medicare taxes. Withhold federal social security and Medicare taxes.

This lowers your taxable income and saves you money on. This also applies to Christian Science practitioners and members of a religious order who have not taken a vow of poverty. If youre expecting a big refund this year you may want to adjust your withholding to have more take-home pay each pay period.

If you are a Federal Work Study student employee please note this does not automatically make you exempt from taxes. There are seven tax brackets that range from 300 to 699. Forgiveness of Paycheck Protection Program PPP loans.

At the other end the bottom 20 which receives 35 of all income pays 19 of all taxes. A In General--Section 7a of the Small Business Act 15 USC. If your paychecks seem small and you get a big tax refund every year you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form.

The higher the number of allowance the less tax taken out of your pay each pay period. Aug 8 Baby formula shortage is easing for many but it still isnt over. And B by adding at the end the following.

Your taxes may also be impacted if you contribute a portion of your paycheck to a tax-advantaged retirement savings account. Taxes taken out of paycheck is not the same for every employee. Gross Paycheck --Taxes-- --Details.

Wages commissions income or net earnings from self-employment capped at 100000 on an annualized basis for each employee. You can choose to have no taxes taken out of your tax and claim Exemption see Example 2. See Form 5329 Additional Taxes on Qualified Plans Including IRAs and Other Tax-Favored Accounts to figure the excise tax.

636a is amended-- 1 in paragraph 2-- A in subparagraph A in the matter preceding clause i by striking and E and inserting E and F. The amount of federal taxes taken out depends on the information you provided on your W-4 form. The top of the W-4 does.

Loans can be for up to two months of your average monthly. F Participation in the paycheck protection program--In an agreement. For more information see Pub.

For 2016 you are required to withhold 62 for social security taxes and 145 for Medicare taxes. The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes. How Your Indiana Paycheck Works.

State and local taxes assessed on compensation. Federal Income-- --State Income-- --Local Income-- --FICA and State Insurance Taxes-- --Details. If your situation is that no federal taxes were taken out of your paycheck youll still have to pay this penalty although it is a relatively small one based on a percentage of the taxes you.

More Information on Paycheck Taxes. Contributions to these plans are considered pre-tax and are therefore exempt from federal income tax during the year in which you make the contribution.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Online For Per Pay Period Create W 4

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Do You Know What S Being Deducted From Your Paycheck Gobankingrates

Paycheck Taxes Federal State Local Withholding H R Block

Different Types Of Payroll Deductions Gusto

Types Of Taxes Anchor Chart Economics Lessons Financial Literacy Lessons Teaching Economics

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Understanding Your Paycheck

Paycheck Calculator Take Home Pay Calculator

Payroll Deduction Form Template Unique 10 Payroll Deduction Forms To Download Payroll Deduction Payroll Template

Check Your Paycheck News Congressman Daniel Webster

Paycheck Calculator Take Home Pay Calculator

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

What Is Tax Withholding All Your Questions Answered By Napkin Finance